Pay It Forward: Bad Movie, Terrible Policy

A few clients, tenants and landlords alike, have recently come to me to deal with situations caused by the rental policy of “paying it forward” when it comes to tenants’ security deposits. It’s a policy that comes up most commonly in rental situations where there’s a full apartment or house being rented by people that aren’t renting it collectively as a cohesive group, and where you have tenants that aren’t all on the same lease and are moving in and out at different times. The way it usually works is that the incoming tenant pays the outgoing tenant the security deposit, hence paying it forward. In theory the practice works – but like everything else in this world, it works until it doesn’t, and what happens then? The answer – nothing good for either the tenant or the landlord.

“Pay it forward” arrangements are not permitted under Maine law. Maine law requires the landlord to keep tenant security deposits and there are a lot of requirements and restrictions on how security deposits can be treated. For example, the landlord has to keep it in a separate bank account just for security deposits, and the tenant is entitled to know the bank and account number where it’s being held. Landlords have to return security deposits within 30 days of move-out, and can legally only deduct certain things from the deposit. Those are just a few of the requirements. Landlords who fail to follow all of the requirements are liable to the tenant for double the amount of any security deposit wrongfully withheld plus court costs and attorneys’ fees, and on top of that, monetary penalties payable to the tenant.

Landlords are held to security deposit laws whether they collect the security deposits themselves or let tenants “pay it forward.” Many landlords think that if they let the tenants handle security deposits, that they’ve opted out of the system and can’t be held liable for any mishandling of security deposits by their tenants. This couldn’t be farther from the reality – Maine law holds all landlords to those requirements – so the landlord is still required to follow the law of security deposits and is still liable to the tenant even if he or she chooses to let their tenants handle security deposits.* As a landlord, knowing that you could be held liable and ordered by a court to pay thousands of dollars in penalties for actions you neither controlled or maybe didn’t even know about, wouldn’t you want to take control of your security deposit situation? All it takes is one bad tenant experience to throw the whole setup out of whack with the end result the landlord paying out double security deposits that he never held in the first place.

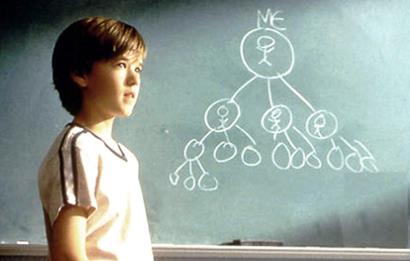

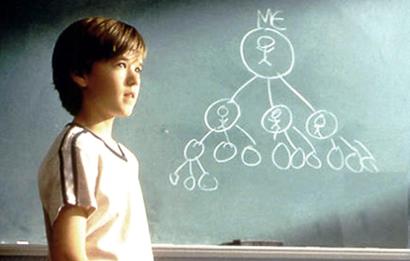

The “pay it forward” policy often leaves tenants high and dry. It doesn’t take a lot of brainstorming to think of ways that this policy could backfire. Say you’re renting on one of these agreements and the landlord decides to sell the house. Where does your security deposit refund come from if there’s no next tenant to pay it forward? What happens if the landlord can’t find a new tenant to take your spot? Where does your security deposit come from? What if the previous tenant damaged the space and it has to be repaired? Where does that money come from? Can you find where your security deposit went on Haley Joel Osment’s chart? Because that’s basically the scenario you’re looking at if you need to track it down.

The “pay it forward” policy often leaves tenants high and dry. It doesn’t take a lot of brainstorming to think of ways that this policy could backfire. Say you’re renting on one of these agreements and the landlord decides to sell the house. Where does your security deposit refund come from if there’s no next tenant to pay it forward? What happens if the landlord can’t find a new tenant to take your spot? Where does your security deposit come from? What if the previous tenant damaged the space and it has to be repaired? Where does that money come from? Can you find where your security deposit went on Haley Joel Osment’s chart? Because that’s basically the scenario you’re looking at if you need to track it down.

Maine laws on tenant security deposits are there for very good reasons – they protect both landlords and tenants from misuse of the security deposit, they ensure that security deposits are safely and properly kept and that tenants get their money back when they move out. Operating outside those laws is a recipe for disaster. You may think you’re avoiding headache and hassle by paying it forward, but whether you’re a landlord or a tenant, operating under that type of policy leaves you exposed to getting burned worse than Kevin Spacey’s character in the movie.

If you’re a landlord or a tenant and you’re currently renting with a “pay it forward” agreement, contact me to talk about fixing that. It’s a very simple fix that can be done mid-tenancy, and is exponentially cheaper and easier than trying to fix the inevitable mess that these kinds of agreements can create. There are no penalties for fixing your security deposit arrangements if they’re currently not compliant, so take some time and fix that now before it becomes a bigger problem down the road. For tenants currently in a “pay it forward situation,” I can give you an easy and non-confrontational way to approach your landlord about this; after all, doing it by the book protects everyone involved.

So while Rotten Tomatoes gave Pay It Forward the movie a 40% rating, I give pay it forward the security deposit policy a 0% rating.

* – There are exceptions to this law for two-unit buildings where the owner lives in one of the units. However, even though the law has an exception for those properties, it still makes sense to treat tenant security deposits in accordance with the laws set forth at 14 M.R.S.A. § 6031, et seq. in order to avoid the logistical pitfalls that invariably occur with these arrangements.